Introduction

Why JGAAP Compliance Matters for Japanese Businesses

How Dynamics 365 Business Central Aligns with JGAAP

The Role of Sysamic

Why Business Central is the best ERP of Choice for Japanese Accounting

Conclusion

Introduction

For Japanese businesses, compliance with JGAAP (Japanese Generally Accepted Accounting Principles) is not optional—it is the cornerstone of corporate governance, investor trust, and smooth regulatory reporting. In Japan’s competitive and highly regulated market, accounting systems must do more than capture transactions; they must align seamlessly with evolving standards, integrate with tax and e-invoice mandates, and provide transparency to both local and global stakeholders.

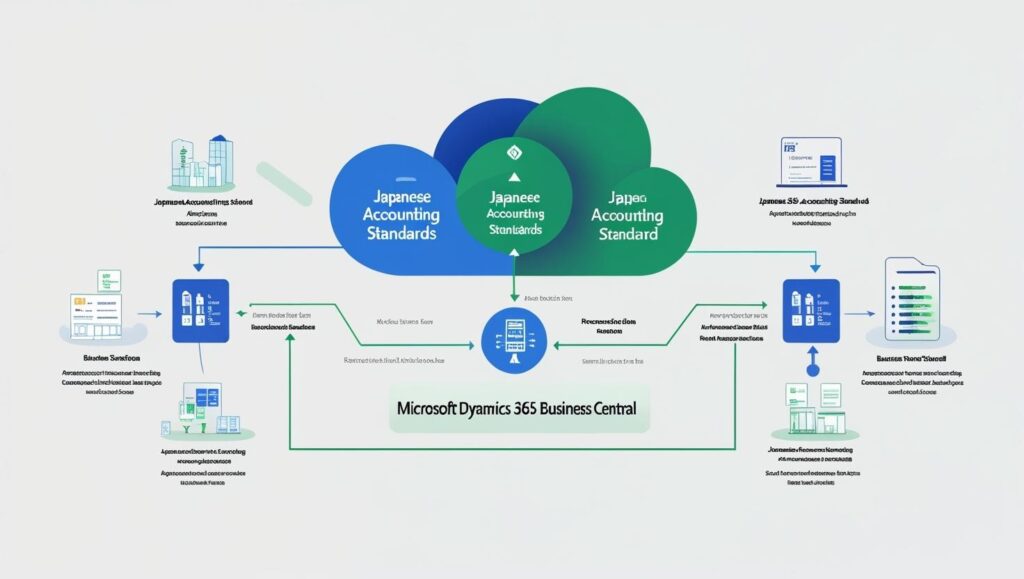

This is where Microsoft Dynamics 365 Business Central stands out. As a modern cloud-based ERP (Enterprise Resource Planning) system, Business Central is designed to adapt to local accounting requirements while supporting international standards such as IFRS (International Financial Reporting Standards). With the right partner, such as Sysamic, Japanese organizations can confidently navigate the complexities of financial compliance while building a scalable foundation for growth.

Why JGAAP Compliance Matters for Japanese Businesses

Unlike IFRS, which prioritizes global comparability, JGAAP emphasizes conservatism, detailed disclosures, and strict recognition rules. Japanese businesses must comply with requirements such as:

Revenue recognition based on realization rather than probability.

Expense recognition with strict rules for depreciation and amortization.

Detailed segment reporting for financial transparency.

Tax-effect accounting aligned with Japanese corporate tax law.

Financial statement formats prescribed by the Financial Services Agency (FSA).

These are not “nice-to-have” features; they are mandatory for statutory filings, audits, and investor confidence. An ERP solution that fails to meet these standards exposes businesses to compliance risks, inefficiencies, and costly manual workarounds.

How Dynamics 365 Business Central Aligns with JGAAP

Flexible Chart of Accounts and Localization: Business Central allows for a customizable chart of accounts that can be structured to meet JGAAP requirements. Japanese organizations can define account categories and sub-ledgers that align with statutory formats, while still supporting management reporting in IFRS or other frameworks.

Revenue and Expense Recognition: With deferred revenue and expense schedules, Business Central supports recognition rules critical under JGAAP. For example, subscription-based businesses can automate monthly revenue recognition in compliance with Japanese accounting policies, reducing manual calculations.

Fixed Asset Management: Depreciation rules under JGAAP often differ from international practices. Business Central’s fixed asset module allows companies to define depreciation methods (straight-line, declining balance, etc.) according to Japanese tax regulations, ensuring accurate expense recognition and compliance.

Tax-Effect Accounting and Integration: Because JGAAP closely ties accounting with taxation, Business Central’s integration with Japanese consumption tax and corporate tax calculations ensures accurate deferred tax accounting. Companies can manage both book and tax records within one platform, reducing reconciliation efforts.

Localized Financial Reporting: Business Central supports localized financial statement templates, enabling companies to generate reports directly in formats recognized by Japanese regulators and auditors. This includes balance sheets, income statements, and cash flow statements structured per JGAAP guidelines.

Multi-Standard Support (JGAAP + IFRS): For global-ready Japanese enterprises, Business Central allows for parallel reporting in JGAAP and IFRS. This dual capability is invaluable for subsidiaries of multinational corporations or domestic firms planning overseas expansion.

The Role of Sysamic

While Business Central provides the foundation, implementation is where compliance succeeds or fails. Sysamic, as a dedicated Dynamics 365 Partner in Japan, brings deep expertise in:

JGAAP configuration and localization: Aligning Business Central’s modules with statutory Japanese accounting requirements.

Regulatory updates: Continuously adapting systems to reflect changes in JGAAP, tax laws, and e-invoice mandates.

Integration with Japanese systems: From payroll to tax filing platforms, ensuring smooth connectivity with the Japanese business ecosystem.

User adoption and training: Empowering Japanese finance teams to leverage Business Central confidently in daily operations.

Sysamic’s approach goes beyond software deployment—we provide strategic guidance, compliance assurance, and ongoing support, ensuring that Business Central becomes a driver of both compliance and efficiency.

Why Business Central is the best ERP of Choice for Japanese Accounting

In a market where financial accuracy and compliance define corporate reputation, Dynamics 365 Business Central offers Japanese organizations:

A future-proof ERP aligned with both JGAAP and global standards.

Cloud scalability for growing businesses without infrastructure burden.

Smooth integration with Microsoft 365 (Office tools), enhancing collaboration across finance teams.

Automation and efficiency in revenue recognition, asset management, and reporting.

With Sysamic as your partner, compliance becomes more than a checkbox—it becomes a strategic advantage.

Conclusion

For Japanese businesses, compliance with JGAAP is not just about meeting regulatory requirements—it’s about building credibility, trust, and sustainable growth. Dynamics 365 Business Central, when implemented and localized by Sysamic, ensures that financial systems are accurate, compliant, and agile enough to support digital transformation.

In a world where financial transparency is non-negotiable, aligning ERP with JGAAP is not just a necessity—it is a competitive edge.

Sysamic is widely trusted in Japan as a Microsoft Dynamics 365 Partner, helping businesses navigate digital transformation with localized expertise and global technology. Specializing in Microsoft Dynamics 365 Business Central, we support Japanese enterprises and global companies operating in Japan with ERP implementations, cloud migration, compliance, and modernization strategies. Our bilingual team ensures clear communication and seamless integration with Japan’s unique regulatory and business environment. Whether you’re adopting Microsoft Azure, deploying Microsoft Copilot, or managing a hybrid workforce, Sysamic delivers secure, scalable, and future-ready solutions

To learn how Sysamic can support your digital transformation in Japan, email us at info@sysamic.com or fill out our contact form here to get in touch.